Rolls-Royce (LSE:RR) shares may seem expensive as they’re up 60% from 2022’s low and the firm remains loss-making. But my calculations are that buying at this level still presents a bargain. Even so, there are caveats I’m considering before increasing my stake.

A steep climb

The FTSE 100 stalwart derives a big chunk of its revenue from its Civil Aerospace division (44%), where it manufacturers and services engines for commercial aircraft. Hence, it’s no surprise to see its share price rally on the resurgence of global air travel.

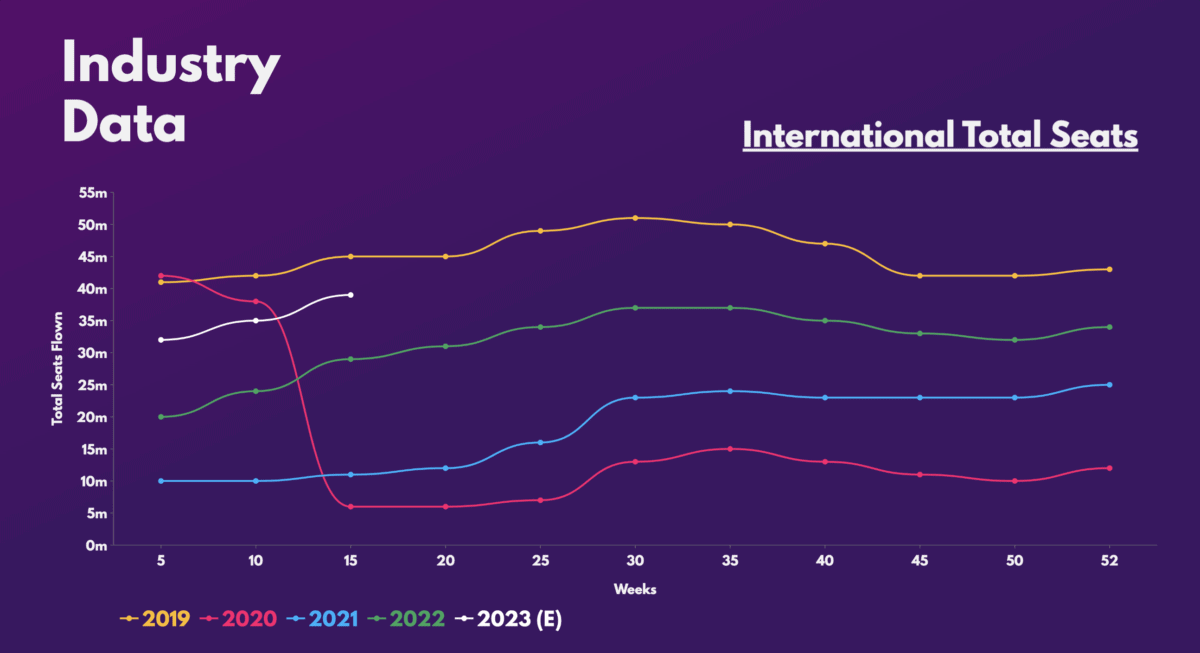

Be that as it may, the firm’s biggest strength as the world’s second-largest engine manufacturer has also been its Achilles heel. That’s because international and long-haul travel continues to lag pre-pandemic levels. When Rolls-Royce last shared its numbers, large engine flying hours were only at 65% of 2019 levels. This is due to the fact that all of its commercial engines are fitted on long-haul aircraft.

Nonetheless, international travel continues to recover with strong forward bookings. Therefore, there’s certainly more upside potential for Rolls-Royce to capitalise on. This is especially the case after China recently ditched its zero-Covid policy.

Too high, too quick?

Having said that, the rapid rise of Rolls-Royce shares has gone too far, some analysts believe. They argue that the stock has risen too quickly, and is now expensive. However, my DCF model would suggest otherwise, as my calculations give me a target price of £1.37. This presents me with a 30% upside if I were to buy the stock today.

Additionally, my target price is roughly in line with several brokers, such as Barclays (£1.10), Deutsche (£1.36), and Jefferies (£1.25). And although Rolls-Royce doesn’t have a price-to-earnings (P/E) ratio because it remains loss-making for now, its other current and forward valuation multiples support my argument that today’s price is still reasonable.

| Metrics | Valuation multiples | Industry average |

|---|---|---|

| Price-to-sales (P/S) ratio | 0.7 | 1.4 |

| Forward price-to-sales (P/S) ratio | 0.7 | 1.6 |

| Forward price-to-earnings (P/E) ratio | 47.6 | 64.4 |

Nevertheless, it’s worth noting that this is based on the assumption that the Derby-based manufacturer achieves its guidance when it reports its full-year results later this month.

| Metrics | FY22 outlook |

|---|---|

| Revenue | 3% to 6% |

| Operating margin | ~3.8% |

| Free cash flow | “Modestly positive” |

Headwinds to consider

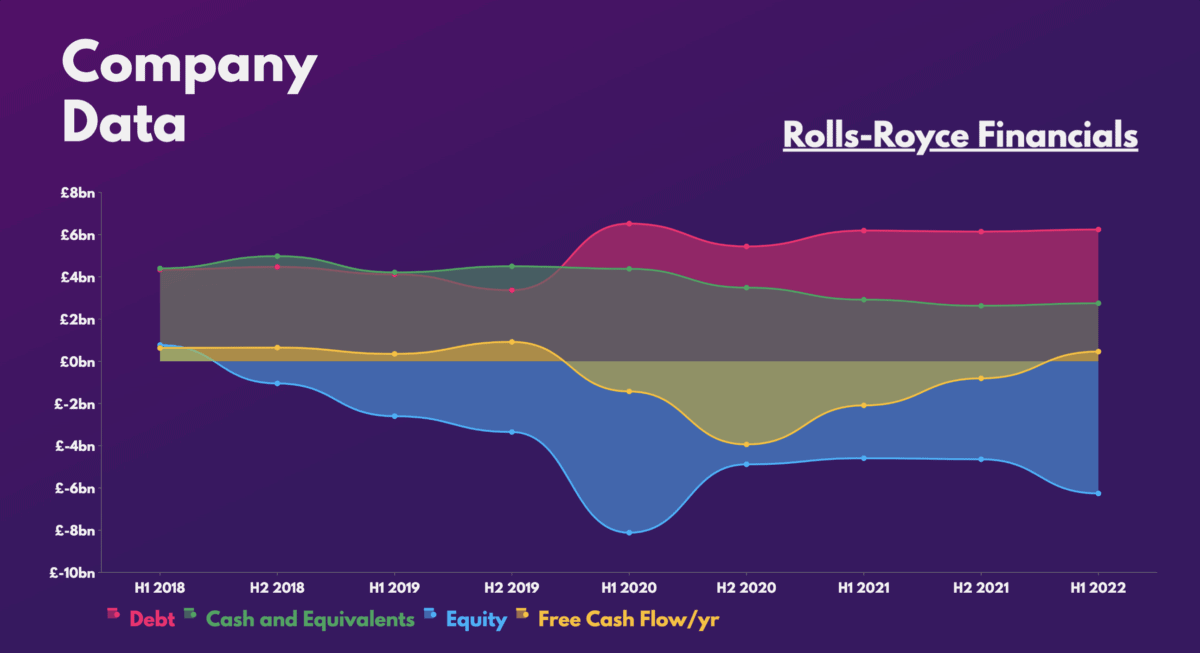

There’s no guarantee that Rolls-Royce shares can continue to rise, even more so when there are a number of headwinds to consider. The most glaring one being the state of its balance sheet.

The engineer has no debt repayments due until FY24. Despite that, high levels of debt are likely to impact its earnings potential in the future. In fact, new CEO Tufan Erginbilgic recently said that this is the “last chance” for the engineer to turn things around.

There’s certainly potential for Rolls-Royce shares to continue their strong rally. I only need to point to a number of catalysts and exciting projects in its pipeline as evidence. The likes of its new UltraFan engine, nuclear small modular reactors, and hydrogen energy are potential money spinners, if successful. But for all that, these promising projects are still a long way from generating meaningful profits.

A radical improvement to its cost structure is what’s urgently needed. And until I see evidence of that, I’m more inclined to agree with Barclays and simply hold my current stake before buying more Rolls-Royce shares.